We help clients achieve financial security by investing in a well-diversified, customizable, and low-cost investment solution.

We believe success in achieving your investment goals is accomplished by time in the market rather than timing the market. We use a well-diversified portfolio that has exposure to major sectors of the US large cap stocks, and to the broader market including exposure to fixed income, international, emerging markets, small cap, mid cap companies, and options income strategies. Portfolios are constructed using high conviction large cap stocks, highly rated, low cost Exchange Traded Funds, and actively managed fixed income Mutual Funds.

We will help you determine your risk profile and select an appropriate portfolio that can range from very aggressive to highly conservative and are tailored to your Risk Number. These portfolios use our best investment ideas regardless of industry, however they can be modified and tailored to your desires if there are certain companies that you want to include or exclude for political, religious or philosophical beliefs. We can also adjust the portfolios to incorporate specific stocks that you own resulting from stock options you acquire through your employer, inherited stocks or other positions you want to own.

Key Strategies:

Asset Allocation

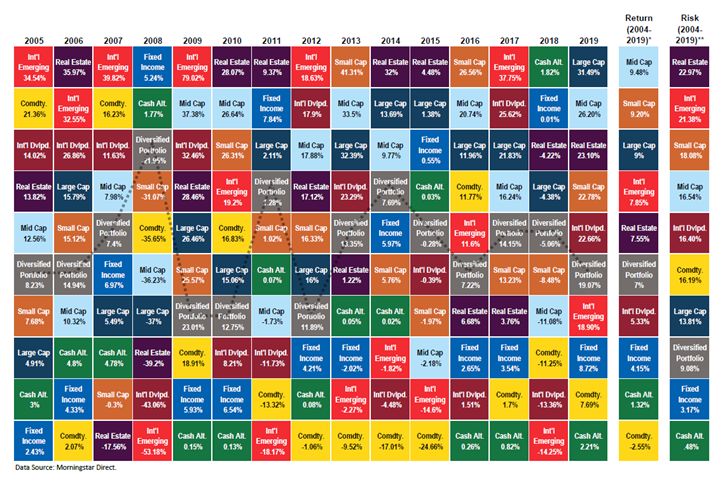

- A well-diversified portfolio that includes exposure to equities and fixed income can reduce overall risk and is foundational to a well-constructed portfolio.

- Invest in a combination of income and growth stock positions. This can allow the portfolio to grow from dividend payments over time, and to grow in value from market appreciation during strong markets.

- More aggressive portfolios hold more weight in growth stocks, while more conservative portfolios hold more weight in dividend paying stocks.

- Use low-cost Exchange Traded Funds to gain exposure to Small and Mid-Cap, Real Estate, Commodities, International, and Emerging Markets positions.

Asset Selection

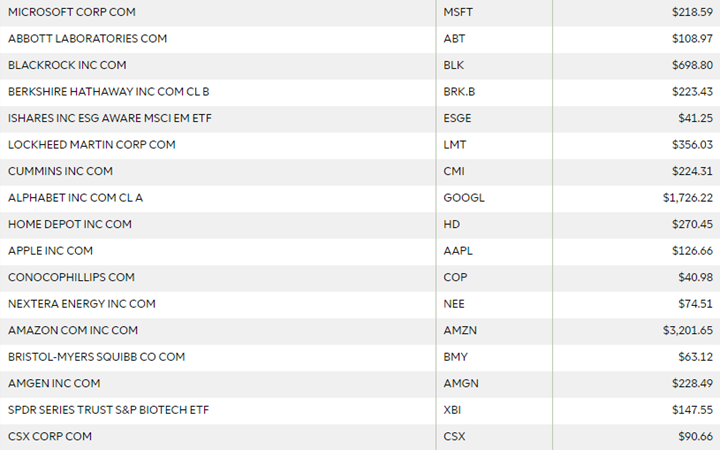

- Use individual stocks to gain low-fee exposure to major US sectors including Information Technology, Industrials, Financials, Energy, Consumer Discretionary, Materials, Communication Services, Health Care, Consumer Staples, and Utilities.

- Use income producing options ETF strategies to generate additional income while maintaining high quality stocks and opportunity for growth.

- Use low-cost Exchange Traded Funds to gain exposure to Small and Mid-Cap, Real Estate, Commodities, International, and Emerging Markets positions.

- Hold opportunistic positions to gain exposure to growth opportunities based on current economic events.

- Offer the ability to customize the portfolio to include or exclude companies based on a client’s social, political, or religious belief.

- Utilizing institutional money managers to invest the fixed income/bond portion of the portfolio.

*These are examples of positions that may be used in a hypothetical portfolio, they are not a recommendation of investments to buy or sell.

Time Related Considerations

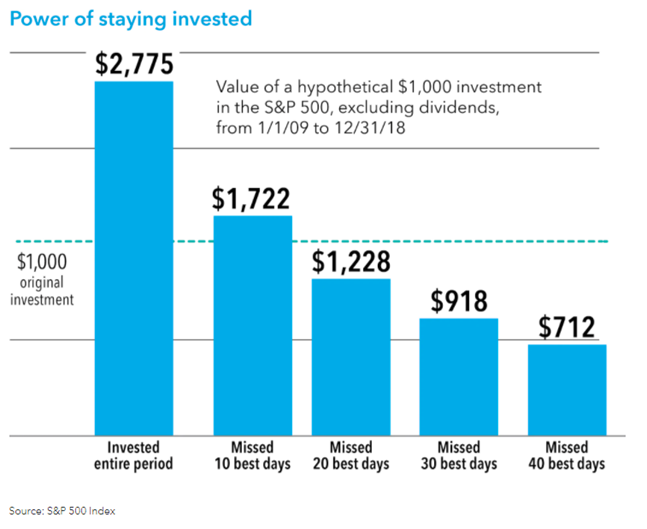

- Time in the market is more important than timing the market.

- Make shifts in the overall portfolio allocation based on economic conditions. For example, opportunistically reducing bond exposure and increasing stock exposure during a severe market contraction.

- Consider using Dollar Cost Averaging and/or a market re-entry plan to invest new money into the market.

- Rebalanced the portfolio on a regular basis, but allow some drift to occur to take advantage of growth opportunities as companies and sectors grown in value over time.

Tax, Distribution Planning and Miscellaneous

- Perform tax loss harvesting as needed to manage tax exposure on non-qualified investment accounts.

- Managing for market conditions when taking distributions from a portfolio to avoid selling low positions if possible.

- Provide behavioral coaching to clients to help avoid making a bad investment decision, especially in a down market.

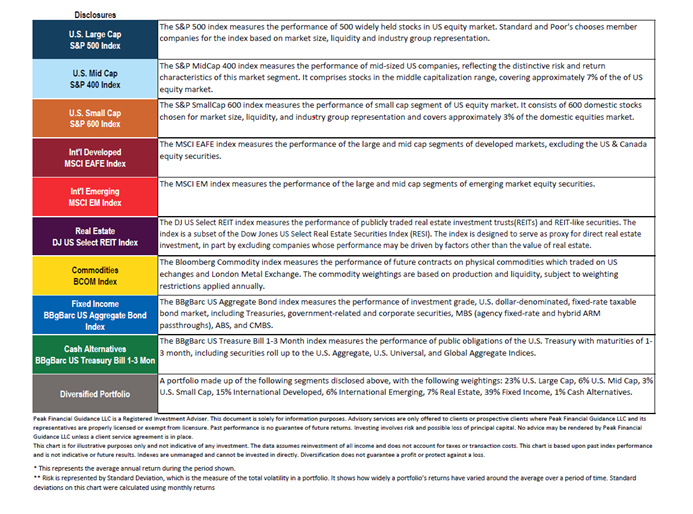

- Using modern technology and analysis programs, including Morningstar and Riskalyze, to communicate the risk and potential returns of a given investment and ensure that it fits within the client’s risk tolerance.

PFG’s methods of analysis and investment strategies incorporate the client’s needs and investment objectives, time horizon, and risk tolerance. PFG is not bound to a specific investment strategy for the management of investment portfolios, but rather consider the risk tolerance levels pre-determined gathered at the account opening, as well as on an on-going basis. Examples of methodologies that our investment strategies may incorporate include:

Asset Allocation – Asset Allocation is a broad term used to define the process of selecting a mix of asset classes and the efficient allocation of capital to those assets by matching rates of return to a specified and quantifiable tolerance for risk.

Dollar-Cost Averaging – Dollar-cost averaging is the technique of buying a fixed dollar amount of securities at regularly scheduled intervals, regardless of the price per share. This will gradually, over time, decrease the average share price of the security. Dollar-cost averaging lessens the risk of investing a large amount in a single investment at the wrong time.

Our strategies and investments may have unique and significant tax implications. Regardless of your account size or other factors, we strongly recommend that you continuously consult with a tax professional prior to and throughout the investing of your assets.

Investing in securities involves risk of loss that clients should be prepared to bear. Although we manage your portfolio with strategies and in a manner consistent with your risk tolerances, there can be no guarantee that our efforts will be successful. You should be prepared to bear the risk of loss.

All investments involve the risk of loss, including (among other things) loss of principal, a reduction in earnings (including interest, dividends, and other distributions), and the loss of future earnings. These risks include market risk, interest rate risk, issuer risk, and general economic risk. Regardless of the methods of analysis or strategies suggested for your particular investment goals, you should carefully consider these risks, as they all bear risks.

PFG does not recommend a particular type of security, but rather we make our recommendations based on the clients’ goals and investment objectives. All investments are subject to an inherent risk of loss. The value of securities in the portfolio can increase and decrease in a moment’s notice. Accordingly, clients can lose money-including principal. The stock market is subject to significant fluctuations in value as a result of political, economic, and market developments. If the stock market declines in value, the portfolio is likely to decline in value. Because of changes in the financial condition or prospects of specific companies, the individual stocks selected by PFG may decline in value, causing the account to decline in value.

Market Risk. The prices of securities in which clients invest may decline in response to certain events taking place around the world, including those directly involving the companies whose securities are owned by the client or an underlying fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. Investors should have a long-term perspective and be able to tolerate potentially sharp declines in market value.

Management Risk. PFG’s investment approach may fail to produce the intended results. If our perception of the performance of a specific asset class or underlying fund is not realized in the expected time frame, the overall performance of client’s portfolio may suffer.

Equity Risk. Equity securities tend to be more volatile than other investment choices. The value of an individual mutual fund or ETF can be more volatile than the market as a whole. This volatility affects the value of the client’s overall portfolio. Small- and mid-cap companies are subject to additional risks. Smaller companies may experience greater volatility, higher failure rates, more limited markets, product lines, financial resources, and less management experience than larger companies. Smaller companies may also have a lower trading volume, which may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger companies.

Fixed Income Risk. The issuer of a fixed income security may not be able to make interest and principal payments when due. Generally, the lower the credit rating of a security, the greater the risk that the issuer will default on its obligation. If a rating agency gives a debt security a lower rating, the value of the debt security will decline because investors will demand a higher rate of return. As nominal interest rates rise, the value of fixed income securities is likely to decrease. A nominal interest rate is the sum of a real interest rate and an expected inflation rate.

Mutual Fund / ETF Risk. When a client invests in open end mutual funds or ETFs, the client indirectly bears its proportionate share of any fees and expenses payable directly by those funds. Therefore, the client will incur higher expenses, many of which may be duplicative. In addition, the client’s overall portfolio may be affected by losses of an underlying fund and the level of risk arising from the investment practices of an underlying fund (such as the use of derivatives). ETFs are also subject to the following risks: (i) an ETF’s shares may trade at a market price that is above (“premium”) or below (“discount”) their net asset value, an ETF bought at a premium may later sell at a Net Asset Value (NAV) or discount; (ii) the ETF may employ an investment strategy that utilizes trading of an ETF’s shares may be halted if the listing exchange’s officials deem such action appropriate, the shares are de-listed from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally. PFG has no control over the risks taken by the underlying funds.